Singapore Management University (SMU)’s Financial Literacy Program for Young Adults which is supported by Citi Singapore and funded by Citi Foundation, organised the inaugural FInHack 2021 from August to October to catalyse innovative solutions to address real world needs. The virtual competition attracted 59 inter-school teams comprising of more than 120 undergraduates and postgraduate students from the six autonomous universities in Singapore.

Nine problem statements championed by several organisations, including CPF Board, MoneySense, Life Insurance Association and non-profit organisation Aidha, were developed in line with the competition’s theme “Financial Literacy in the Digital Age”. They include budgeting and savings for emergencies, retirement planning, early investing, health insurance, engaging youths with special needs on money management topics, women & financial education.

Kicking Off With a Bang

The Hackathon commenced on 16 August 2021 with a Project Briefing Day where Assistant Professor Aurobindo Ghosh, Program Director for the Citi Foundation-SMU Financial Literacy Program for Young Adults, highlighted that FInHack 2021 “contributes to a more financially inclusive society, and in the process, inclusive growth, which is becoming more of a challenge across the board for the whole of government, not just in Singapore, but the entire world.” 24 shortlisted teams were given seven days to submit their proposals on a chosen problem statement.

Program Director for the Citi Foundation-SMU Financial Literacy Program for Young Adults, Assistant Professor Aurobindo Ghosh, delivering the opening address to kick-off the inaugural FInHack during the Project Briefing Day on 16 August 2021

Throughout the week, each team met up with their Citi Singapore mentors to brainstorm ideas and garner feedback. The Citi Singapore mentors played a crucial role in preparing the teams for the hacking process by introducing them to the problem statements and how to break them down, exploring various methodologies to understand the target audience, and encouraging them to plug possible gaps in their solutions.

One of the mentors, Ms Binita Shah, Vice-President for Anti-Money Laundering, Citi Singapore commented, “FInHack 2021 was a truly wonderful opportunity to provide guidance to the youths of today. It also let us all grow as a team since we regularly learned, unlearned and relearned in order to explore and select the best outcomes possible to lead us to victory!”

Top 5 Finalists of the Financial Inclusion Hackathon (FInHack) 2021 alongside Project Champions, Citi Singapore Project Advisors and SMU Judges during the Pre-Demo Day Interview on 9 September 2021.

The top five teams advanced to the finals where they were invited to pitch to a panel consisting of their respective Project Champions (owners of the Problem Statements), Citi volunteer mentors and SMU faculty during a Pre-Demo Day interview on 9 September 2021. They then set the floor alight with an electrifying 2-minute elevator pitch on their ground-breaking solutions for live audience voting during the Hackathon Demo Day on 10 September 2021, which coincided with the 8th Citi Foundation-SMU Financial Literacy Symposium. The scores aggregated from the Pre-Demo Day Interview and live audience voting during the Hackathon Demo Day were tabulated to determine the top 3 winning teams.

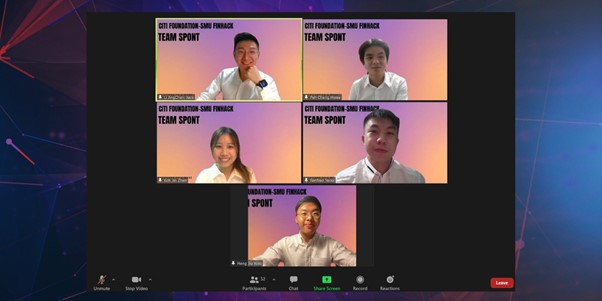

Team SpONT

Clinching the top spot is a team comprising first and second-year undergraduate students from NTU and NUS. Team SpONt’s proposed solution is a mobile application which enhances the financial knowledge of youths with special needs entering the workforce by engaging them on money management skills and topics through games as well as budget tracking tools. At the same time, the application extends to caregivers of youths with special needs. The app has two unique features: a duo-player mode to promote bonding between caregivers and care receivers, and an audio function for users who are visually impaired.

Clockwise L-R: Jace Li, Peh Cheng Hwee, Renfred Yeow Yong An, Heng Jiu Xiao and Koh Jin Zhen.

Their solution greatly impressed their Project Champions – CPF Board’s Youth Engagement Team. Ms Amanda Sim, Manager, lauded the team’s effort, “Team SpONt showed great enthusiasm in sharing their solutions and how they tackled our problem statement. They displayed compassion in their strive for financial inclusion for those underserved within our community. The split-screen/ duo-player feature of their proposed application was commendable – this suggested Team SpONt’s keen understanding on the importance of the caregiver’s role in the learning process for youths with special needs. Caregivers are able to monitor their progress and motivate these youths through the interactive feature.”

The CPF Youth Engagement Team is currently looking at how Team SpONt’s proposed solution can be incorporated into their ongoing youth engagement plans and the feasibility to operationalise the solution at special education schools in the near future.

The team’s journey to success was not a bed of roses. Team leader Peh Cheng Hwee (NTU, Business Year 2) spoke about the challenges and stumbling blocks they faced along the way. “The biggest challenge that we encountered was reaching out to our target groups, namely the youths with special needs who are about to enter the workforce (primary group) and caregivers (secondary group). Being able to reach out to these groups would have helped us garner constructive feedbacks for our solution.”

With the support of CPF Board and SMU, the team managed to overcome this obstacle and carried out interviews with representatives and teachers at special needs education institutions such as Metta School, SG Enable and Pathlight School to gather feedback on their application and modifications that met the needs of the target groups. This allowed them to better understand the level of financial education that youths with special needs receive.

Team Dean’s Lit

Coming in second was Team Dean’s Lit, comprising mainly Year 2 students from the SMU School of Computing and Information Systems. Their proposed solution is Lit App, an all-in-one mobile platform that allows users to monitor their budgets and receive personalised budgeting recommendations, The app also provides users with access to automated expense tracking, dynamic AI budgeting, budget streak point system as well as social features to motivate one another to improve their financial savviness through a virtual community.

With their solution, the team hopes to impact fresh graduates the most. Amid the uncertainty and softness of the job market due to COVID19 pandemic, the team felt that many fresh graduates are not aware of how they can manage their earnings after they find work, or how to create a savings plan. As a result, many of them were not adequately prepared for situations where there is a sudden change in income levels.

Team leader Yan Jiaxing said, “Budgeting and apportioning of income for savings and emergency funds has never been more important for fresh graduates. Hence, we wish to bridge the gap and make budgeting easy for them to adopt.”

Clockwise L-R: Ng Jun Kai Caleb Shawn, Yan Jiaxing, Teo Wei Hern, Soo Yu Rong Arick, Yeo Wei Ni.

On the skills that they have picked up from the Hackathon, Jiaxing shared “Our team has learnt a great amount in User Interface / User Experience (UI / UX) design, design thinking, prototyping skills as well as how to conduct market research and user testing for our prototype to prove the feasibility and desirability of our concept.”

Team smtd

Team smtd, comprising a mix of Year 1 to Year 4 students from SMU and SUTD, came in third position. Their solution is a web-based platform that aims to educate, identify gaps in existing coverage, and guide Singaporeans to select appropriate insurances that bridge these gaps so that they are always in line with their preferences. This is done through four steps: completing a profiling questionnaire, uploading existing policy for evaluation, identification of gaps between existing policies and preferences, connecting users to their preferred insurers.

Clockwise L-R: Lee Jia En Jace, Kevin Richan, Hng Xin Hui Phoebe, Teo Jia Wei, Ryan Pan Tang Kai

Unlike many corporate hackathons which mainly steered towards innovation for existing clients, the team was attracted to participate in FInHack 2021 due to its social impact. They chose to work on the problem statement – helping Singaporeans to select appropriate health insurance – as they felt this was a pressing need in society.

“More often than not, when you ask Singaporeans about their insurance policies, they are either unsure about their preferences or let their insurance agent take care of everything for them. This results in a lack of knowledge and over-reliance which may result in under-insurance or over-insurance as their agents over recommend those products,” said Teo Jia Wei, a Year-4 student at SMU Lee Kong Chian School of Business.

Team smtd’s solution aims to completely revolutionise the way Singaporeans understand, manage, and select their own insurance policies. Their platform is able to showcase the gaps in users’ existing policies via scenario simulation so that it is relatable to people. Simple and direct recommendations are then provided to guide the user on how to close these gaps depending on whether the person is under-insured or over-insured.

Describing the lessons that the team learnt in their journey, Jia Wei said, “Communication is key especially when we describe the features that we think could benefit the users. Being able to pitch it effectively to interviewees heavily affect their final rating of our solution and I believe my team had put in lots of effort in carrying out the focus group interview to explain our holistic insurance solution.”

The three winning teams won $2000, $1500 and $1000 worth of prize vouchers respectively and the opportunity to run a Proof-of-Concept under the mentorship of their Citi mentors and in consultation with their respective Project Champion.